High profit growth

Despite the macroeconomic situation with higher interest rates and rising inflation, White Pearl Technology Group (WPTG) managed to organically increase the turnover by 18% to 123 (104) MSEK in the second half of the year, with all four business areas contributing. This is however a lower growth rate than in the first half of the year when revenue increased by 49%. The company management explains the lower reported growth rate by stating that a larger proportion of projects could not be invoiced. On an annual basis, turnover increased by approximately 30% to 240 (183) MSEK, which according to the company management provides a good indication of the underlying growth of the Group. The business area, Implementation Services grew the fastest during the year and now accounts for 33% of the revenue. Considering that this area, according to our assessment, has higher profitability than average, it contributed positively to the result development. For the full year, the gross margin was approximately the same as the previous year, but the gross margin in H2 increased by 3 percentage points to 41%. Despite the significant increase in the company's costs - partly due to the changed Group structure - the operating margin improved. It amounted to 13,8% for the full year where the margin for the second half of the year was slightly lower (13,1%). With an operating result for the full year of approximately 33 (19) MSEK and the sale of certain IP assets, the company was able to report an improvement in its financial position. At the end of the year, the Group’s cash position amounted to 11 (8) MSEK, while financial debt decreased to 40 (57) MSEK. This occurred despite the fact that accounts receivable increased by more than 60% due to the strong growth. The company management does not feel concerned about this increase considering an increased proportion of milestone-based projects with longer billing periods.

Intensive work on acquisitions

After not consolidating any new businesses during 2023, the end of last year and so far this year have involved a large number of transactions. During the quarter, the Group signed letters of intent to acquire 50% of the shares in 3 different companies. One of these companies was then acquired in early 2024. The company is named Ataraxy Group, a local player in digital solutions in Uruguay, where the remaining part will be owned by the company's two founders. Ataraxy is estimated to generate a turnover of approximately 3 MSEK in 2024. Through the acquisition, WPTG broadens its product portfolio in the Latin American market, while the opportunities for collaboration in the hardware market in China and India are enhanced. In 2024, WPTG also made an offer to acquire the Swedish company Ayima Group, with payment via its own shares. Based on the proposed exchange ratio (0.6 shares in WPTG for one share in Ayima) and today's share price for WPTG, it corresponds to a purchase amount of approximately 28 MSEK. WPTG sees several synergies with the acquisition and at the same time it would broaden WPTG's existing product and service portfolio. In 2023, Ayima had a turnover of 130 MSEK with an operating result of -17,4 MSEK. We consider it likely that the offer will be accepted since the Group has received binding commitments to accept the offer from shareholders in Ayima, corresponding to over 60% of the votes. Considering the negative results in Ayima and the increased number of shares in WPTG as a result (+19%), this acquisition could initially lead to a deteriorated operating result and profit dilution. However, we have full confidence in the company management's ability to eventually turn the situation around in Ayima and leverage the company's technology in its own operations. Nonetheless, in our opinion, a merger would undoubtedly raise the risk level.

Significant upside in valuation

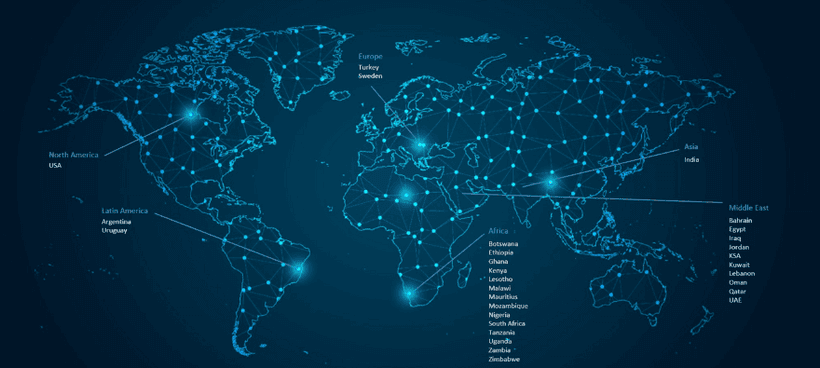

With growth for the "old" WPTG of 20% (slightly lower than the level for 2023) and Ayima being consolidated from the middle of the year, our revenue forecast for the year would increase to 354 MSEK. This should be compared to our previous forecast of 294 MSEK. Despite including an operating loss for Ayima in our forecast for H2, this would still mean that WPTG can report an increase in operating profit this year. In our new forecast, the operating profit is 41,1 MSEK, compared to our previous forecast of 40,6 million SEK, representing an improvement of 23% compared to 2023. However, this would mean that the Group's operating margin would decrease to 12% in 2024. In our opinion, this is still a high margin for a rapidly growing company but would result in a decrease in earnings per share. For 2025, we estimate that the revenue will increase by over 30%, driven by Ayima being fully consolidated and that the company's other business areas continue to perform well. Assuming that Ayima will contribute a break-even result in 2025 and also report lower margins than the Group in general in 2026, the operating margin will start to rise again. Considering that this type of strong growth naturally becomes harder to achieve as the Group grows larger, we have conservatively forecasted a revenue increase of "only'' 13% for 2026. This results in a forecast that the Group will reach a revenue of 536 MSEK in three years' time and an operating profit of 67 MSEK. WPTG operates in a large number of politically unstable countries, although the number of countries (30) where operations are conducted constitutes a stabilizing factor. The Group is also relatively unknown in Sweden due to the fact that operations so far (before the expected acquisition of Ayima) have been concentrated in countries outside of Europe. However, we assess that as the knowledge about the company increases and that the company can continue on a stable growth trajectory, the valuation will also increase. The improvement in the company's financial reporting that occurred in 2023 also, in our opinion, represents a step forward. Based on our new forecasts, our DCF-calculation yields a market value of 385 MSEK or 14 SEK per share, representing an upside of approximately 120% based on today's share price. However, we are fully aware that such a valuation requires further reports that support the company's development trajectory and that the knowledge about the company increases.

Disclaimer

This publication (hereinafter the "Publication") has been compiled by TradeVenue AB (hereinafter "TV") exclusively for TV's customers. The content is based on information from publicly available sources which have been deemed reliable. The accuracy and completeness of the factual content as well as the forecasts cannot therefore be guaranteed. TV may have employees from another department or analyzed company (hereinafter the "company") read facts or series of facts to have them verified. TV does not provide conclusions or judgments in advance in the Publication. Opinions expressed in the Publication are those of the analyst at the time the Publication was prepared and may change. There is no assurance that future events will be consistent with opinions expressed in the Publication.

The information in the Publication should not be construed as an invitation or advice to enter into transactions. The information does not target the individual recipient's knowledge and experience of investments, financial situation, or investment goals. The information is therefore not a personal recommendation or investment advice.

TV disclaims all liability for direct or indirect damage that may be based on this Publication. Investments in financial instruments are associated with economic risk. The investment can increase or decrease in value or become completely worthless. The fact that an investment has historically had good value development is no guarantee for the future.

The Publication may not be distributed to or made available to any physical or legal person in the United States (except as provided by Rule 15a - 16, Securities Exchange Act of 1934), Canada, or any other country that has established restrictions on the distribution and availability of the material.

Neither TV nor the persons who compiled this publication hold (either long or short) positions in the analyzed company's issued financial instruments exceeding 0.5% of the analyzed company's share capital.