Status report Beyond Frames

During 2023, I conducted two interviews with the CEO of Beyond Frames and when the company recently released its Q1 report, I thought it was a good time to follow up on the situation about six months after the last post.

To start with a bit of repetition, Beyond Frames operates in the AR/VR gaming segment and the stock is listed on Spotlight Stockmarket with a market capitalization of just under 400 MSEK. During the earlier interviews, we looked both specifically at the company and at the AR/VR industry in general.

This year's Q1 report was strong, marking the fifth consecutive quarter where the company showed strong revenue growth. Both EBITDA and operational cash flow were positive. Here, you can read a report commentary from TradeVenue's analysts, including a positive forecast for the results in 2024, 2025 and 2026. The commentary makes certain assumptions about the gross margin, which I consider a key issue moving forward, prompting me to inquire about this in the interview.

You can find the interview below.

Could you please start by telling us a little about what has happened in the industry in general since the last time? For example activity and sales from Meta and Apple. And maybe something about the market growth in total.

There were a couple of pieces of big news in Q1. Apple launched their Vision Pro headset, which seems to be performing well with enterprise customers, with 50% of Fortune 100 companies adopting the platform at launch. Given that the Vision Pro was positioned as a business machine, this is a promising sign for continued support from Apple into the future. Meta announced a 30% revenue increase for their Reality Labs segment versus the prior quarter, driven by Quest hardware sales. Another positive underlying signal of the category’s growth.

Beyond Frames have delivered good turnover growth for five quarters in a row now. Is it the same main drivers as when we spoke last fall?

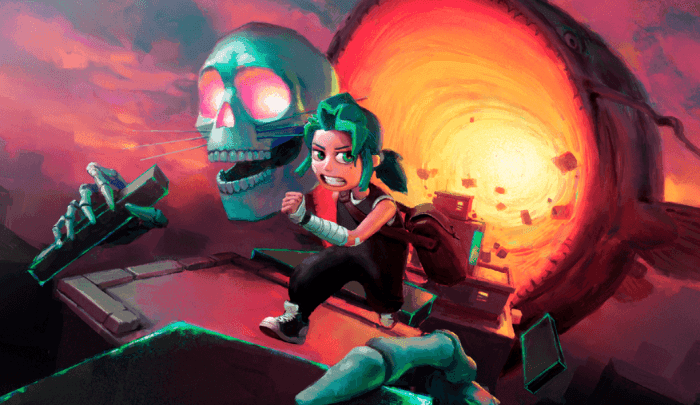

Yes, they’re the same drivers. Our hit publishing title, Ghosts of Tabor, re-launched to the main Meta Quest store from the early access platform, App Labs. This meant more exposure for the title to new audiences. We also had a few major paid milestone deliveries approved for the 3 games currently under development with our flagship studio, Cortopia. Our diversified strategy is still our focus.

The turnover growth also resulted in a better EBITDA and a positive cash flow. But a gross margin of 16% feels low. Can you explain a little how you report turnover and margin and how different games differ in margin and risk?

Sales for Beyond Frames are revenues before store fees and royalty shares with partners. Our business is split into 2 main categories: studio and publishing. Studio is focused on developing games in-house that sell for higher margins. Publishing is focused on distributing and selling other studios’ games that aren’t part of Beyond Frames. These publishing rights are generally acquired at low cost in return for a smaller share of revenues.

Ghosts of Tabor, a game we purchased the publishing rights to relatively inexpensively, was a significant driver of our top-line revenues. The strength of our publishing strategy is that we can put more games in market at low cost. This reduces our risk and means an average net-positive return for our portfolio. A weakness of the strategy is that our margins appear weaker when we have a big hit in our publishing portfolio, like we do now. A big hit within our studio portfolio would have an equal but opposite positive impact on our margins.

Do you have any guidance or official target for margin going forward based on your pipeline and strategy?

Our portfolio strategy is built to improve margin over time. We use the data and efficiencies gained from our soft-margin, low-risk publishing portfolio to create games through our high-margin studio developments. The result should be a much higher margin in the coming years.

Let's look a little more at the pipeline of new games. I saw in the latest report that you have 6 games in development. What can you tell us about these games when it comes to development, financing and date for launch?

We have 3 games in our studio portfolio from Cortopia, all of which are co-financed with partners and fully funded without additional outside funding to bring them to market. In no particular order, the first of these games is the sequel to one of the best-selling VR games of all time. The second of these games is a game based on a famous intellectual property known all over the world. The third of these games is one of our own IPs. All 3 have built-in audiences, which we believe significantly improves their probability of success. In terms of financing, we’ve secured over SEK 58 million from distributors and external publishers who believe in the success of these titles.

We have 1 game by Odd Raven, a studio in which we have a 38% stake. While we can’t say much about this title, we believe it will be fantastic and a potential dark horse in our lineup.

For publishing, we’re working with the studio who created Ghosts of Tabor, Combat Waffle Studios, on their next 2 titles, GRIM and Silent North. Combat Waffle Studios has a tremendous amount of owned audience who are extremely excited about these next two entries, and we’re already seeing strong buzz among the community.

While we're not ready to officially announce dates, the current plan is to launch all games by H1 2026 at a fairly regular cadence between now and then.